Image via Wikipedia

Image via Wikipedia

Even if you fail to pass licensure examinations for real estate brokers, it is not the end of your real estate investment plans. In fact, real estate brokering may not be the ideal career for most businessmen and professionals who have full time work to do, and there is a world of difference between real estate brokering and real estate investment. Brokering is a good foundation for real estate investment, but it is not a prerequisite.

The threshold question is always when to start investing in real estate. The issue is complicated by stories of failed real estate ventures and bankruptcies which have fanned fears to all the uninitiated. The short answer to the above question is NOW, regardless of whether the real estate market is up or down as market directions offer many opportunities.

After settling the issue of WHEN, is the question of HOW. Many times, the question of HOW is complicated by wrong perceptions that real estate is reserved for those who have adequate capital and funds to start with. These wrong perceptions sometime prevent real estate investment as too often excessive reliance on comfort zones of capital adequacy actually is the reason of inaction or delayed action.

As we progress in this blog, we will discuss actual hands-on cases on real estate investment with benefit of around 15 years of real estate practice, as this blog will not pretend to discuss theoretical concepts.

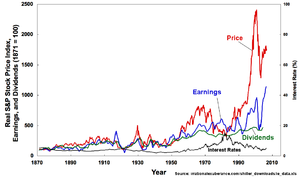

When we say that NOW is the time to start investing in real estate, it should not be literally construed as ACTUAL purchase of real estate property. Firstly, NOW means psychological preparation including clearing of mindsets. Real estate, unlike the stock market, is an investment for the patient and the careful where property appreciation most often is the greatest ROI over a period of time. It is so low profile and boring, especially if you are dealing with small properties.

Secondly, investment in real estate should be in tandem with your long term retirement plans, as the longer you intend to retire, the greater is your ROI in real estate. If executed well, it far exceeds other types of investment, as it actually needs lesser amount of attention and supervision. Therefore, with retirement as one of your reasons in your real estate investment, NOW takes a more urgent role as the earlier you start, the better and greater will be your ROI when retirement time comes.

Finally, as we progress in this blog, we will appreciate that real estate actually complements and improves your chances of success in other types of businesses and investments. In fact, even if you are employed or a professional, real estate may be one of your best chance to secure a comfortable retirement for you and your family.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=fdad4e7d-fdfc-485e-95f9-d9c7340f826c)

No comments:

Post a Comment