Image via Wikipedia

Image via Wikipedia

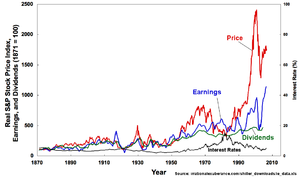

Was it the great physicist Albert Einstein who once said that the eight wonder of world is the power of compound interest? Again obviously, a long head start is needed for savings and its twin concept of compound interest to have a very significant impact on our retirement plans. With very low bank interest these days, savings should be placed in the context of preparations for future investments, especially as savings per se may not be enough to outpace the impact of inflation.

For those in their 20s to 30s, a consistent monthly savings, even though small, will greatly help in subsequent investment activities, especially in real estate. For professionals and those with regular employment, regular savings can be implemented as long we have the correct mindset of thinking in the long run, and paying ourselves first before we disburse our monthly paycheck to other recurring monthly expenses.

In fact, the concept of all educational and pension plans is just founded on savings plus interest plus investment income, except that instead of you controlling your savings and investment, we hire third parties to do the job for us. In the process, we do not control entirely our money placements much as bank time deposits. The need of control is very important especially in situations where other investment options come into play, just like in real estate.

And what is leverage? What is its relation to savings? Unlike savings, leverage is very exciting as you can control and acquire a bigger asset with smaller capital. Who was that philosopher who once said that give me a lever and i will move the earth? Yes, taking control of a property with smaller capital, even as low as 10% of the property's valuation!

Assuming you have generated savings of say, P50,000 to P200,000, the road is now ready for you to embark on your real estate investment. If you are employed, the savings you generated is big plus point if you intend to secure a housing loan with savings banks, or even financing for the acquisition of a house and lot under the Home Development Mutual Fund, Social Security System or the Government Service Insurance System.

Why housing loan? Unlike other forms of financing, housing loan is relatively easy to process with no showing of business track record, as mere membership with the HDMF, SSS or GSIS with corresponding contributions would be generally enough to secure an approval. This may hold true even with savings banks as your banking relationship or track record will hold great weight in securing a fast approval.

The next crucial step is careful research and preparation, mindful of the fact that you will have to get that best bargain in the real estate market. There is no need to rush things as you will have to consider many options, or at least ten options, as many experienced real estate practitioners are doing. The mechanics of this search we will discuss in a separate blog posting.

If your search is well done, there may be a possibility that you will not even shell a single centavo in your real estate acquisition, as you may even be given additional cash to renovate the property as the loanable amount will be greater than the agreed purchase price. Is this possible? Of course, this is doable, but again, we will treat this in a separate blog posting.

What is the target goal here? The target is to generate extra positive cash flow, or cash in excess of monthly amortizations, so that you will again continue to increase steadily your savings nest egg over a period of time, in preparation for your next real estate acquisition, which may happen in another year or two.

Definitely, there will be many what ifs questions. If you have many questions, that is a very positive sign, as that shows you are thinking. Hopefully, our next blog posts will cover your reservations.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=09a22ad7-f6eb-4c7d-a241-314cae6aff6c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=dc404e15-5d9a-4c24-92c5-369809f960a0)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=fdad4e7d-fdfc-485e-95f9-d9c7340f826c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c204950c-59c4-42ce-9c5c-d52880d18caf)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=5be29ca8-0ebc-449a-a6d8-50b196877d55)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=31834a34-4a57-4b3a-8da7-255a3b9aed57)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=dc37748d-28c9-4d6e-8599-d8f5baa8e987)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=c2704633-6c66-4bb9-bd10-621aae9e0ad1)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=360bfb02-167e-46e3-92f0-587c8976e8d3)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=09bd39ef-858b-4f6b-b826-df20e38fa70b)